The holiday rush is over, but for savvy app and game marketers, the work – and the real opportunity – is just beginning. We call this period “Q5” (late December to mid-January). While Q4 is defined by high volume and fierce competition, Q5 is defined by efficiency.

As we have discussed in previous analyses, this window offers a rare convergence of market factors: CPMs and CPIs typically drop as retail budgets withdraw, yet user intent surges. Thanks to holiday gifting, millions of new devices are activated, driving a spike in app store traffic and installs.

At Smadex, we view Q5 as a golden era for User Acquisition and Re-engagement. Here are the key trends we are observing this year and how to adapt your strategy for global markets.

1. The Western Surge vs. The APAC Rhythm

One size does not fit all in Q5.

In Western Markets:

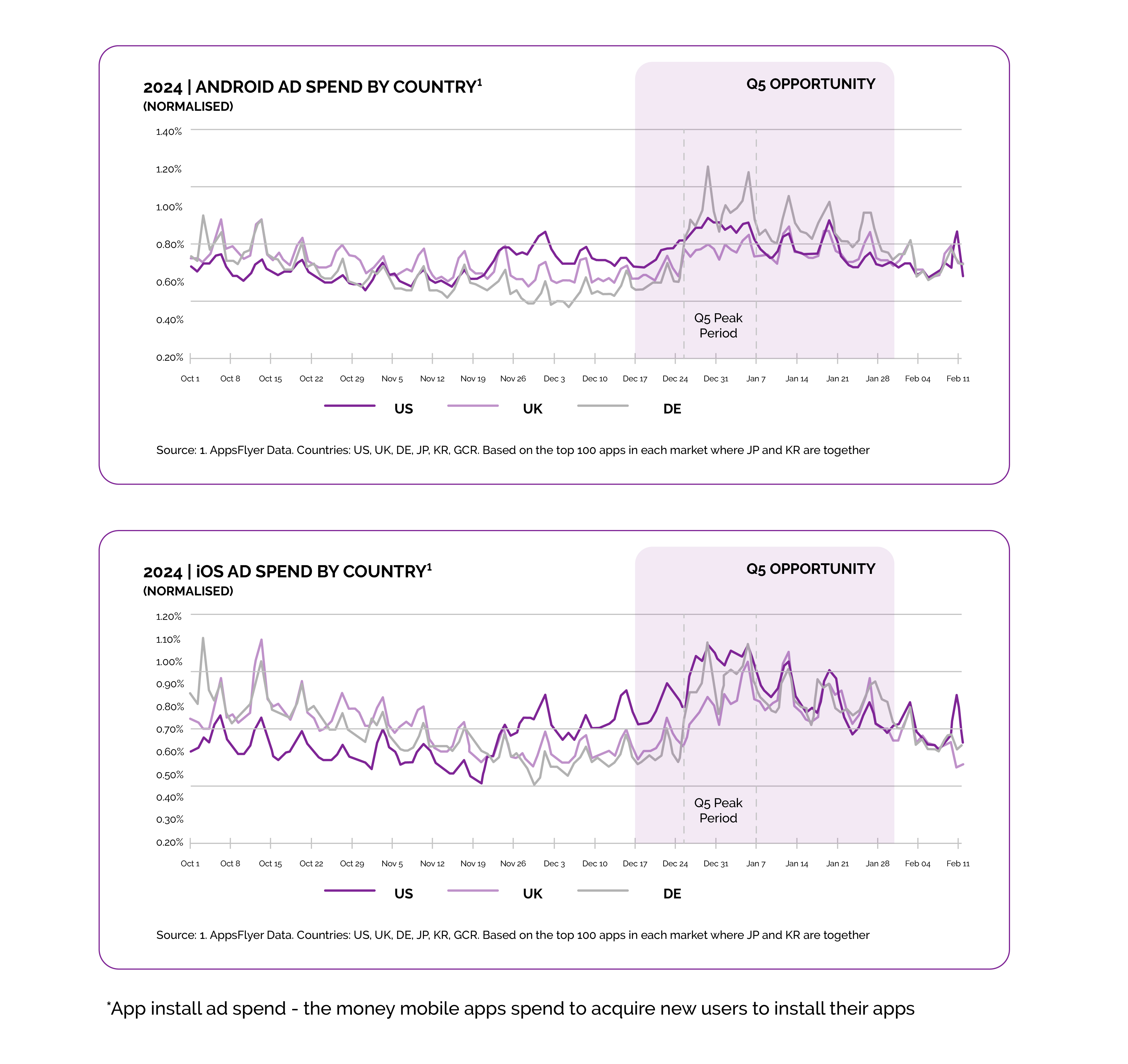

Data from AppsFlyer indicates a significant increase in investment during this period. Advertisers are capitalizing on the momentum of the Christmas and New Year holidays to expand their player base while media costs are low. If you are targeting the US, UK, or Germany, now is the time to maintain or even increase spending to capture high-LTV users on their new devices.

In APAC Markets:

The strategy requires cultural calibration. While paid installs remain strong in Asia-Pacific during Q5, the peak periods differ.

- Japan & South Korea: Campaigns must align with Japan’s Shōgatsu (New Year). South Korea offers a short, post-Christmas window for efficient, high-quality scale before the Lunar New Year marketing begins in the wider region.

- Greater China & Others: Focus on the Lunar New Year cycle. Q5 is crucial for either pre-LNY acquisition or post-LNY retargeting when high-cost traffic stabilizes.

- Southeast Asia: This region is characterized by high mobile penetration and consistent growth. Q5 offers an opportunity for cost-effective scale. Leverage the relatively quiet post-Christmas period to aggressively acquire users through programmatic channels.

2. Tapping into “New Year” Psychology

In North America and parts of Europe, January drives a specific user behavior: Self-Improvement.

We see a sharp rise in demand for “Resolution Apps” – Finance, Health & Fitness, Productivity, and Lifestyle. Conversion rates for these verticals are exceptionally resilient post-holiday.

For Marketers:

Even if your app isn’t about fitness, you can leverage this psychology.

- The Hook: “New Year, New Challenge.”

- The Creative: Refresh your ad assets to feature new in-game goals, season resets, or “fresh start” messaging.

Align your value proposition with the user’s mindset of starting fresh.

3. The CTV Opportunity: Catching the Post-Holiday “Chill”

The overall picture of TV audience behavior is clear: streaming now accounts for over 43% of total US TV viewing time. Furthermore, Connected TV (CTV) is steadily growing its engagement power.

According to key performance indicator (KPI) data from BrightLine, the interaction rate per impression in Q2 2025 was nearly double that of Q2 2024.

This highlights CTV as an increasingly powerful, high-attention medium during the quieter Q5 period. Beyond awareness, CTV allows marketers to monitor performance and make real-time adjustments to optimize results. It provides rich data insights, from second-screen traffic to conversion tracking, ensuring a measurable return on investment.

If you want to learn more about CTV, including data tracking, audience targeting, and successful case studies for app and games marketing, download our comprehensive CTV Guide.

Takeaway

Q5 is the time to pivot from “spending hard” to “spending smart.” By capitalizing on lower CPMs, localizing your approach for local markets, and utilizing high-retention channels like CTV, you can secure a strong trajectory for the year ahead.

Ready to optimize your Q5 strategy? Contact the Smadex team to discuss how we can drive efficient growth for your app.